Bond financing

This is the first bond issue in Russia to be independently verified for compliance with the International Capital Markets Association (ICMA) Social Bond Principles (SBP). The securities are included in the sustainable development sector of the Moscow Exchange. This sector includes issuers with targeted investments attracted in the public market as part of the implementation of projects of high social importance. The Expert RA rating agency has assigned a high rating of structured financing to class A bonds at the ruA.sf (EXP) level, and class B bonds at the ruBBB + .sf (EXP) level. The bonds were issued within the framework of the VIS Group's public-private partnership project that entails the creation of a new network of educational and cultural institutions in Yakutsk and its suburbs.

This is the Group’s debut issue of exchange-traded bonds under the program, with a maximum volume of 30 billion rubles. Securities in the amount of 2.5 billion rubles were issued for 7 years with a put option in 3 years. The funds raised on the public capital market will be used to finance the holding’s ongoing concession projects. The issuer of the securities is OOO VIS FINANCE, the guarantor is the parent company of the VIS Group (AO) holding. The leading Russian rating agency ACRA has assigned an A (RU) rating to the issue.

As part of the registered program, on March 26, 2021, the Group placed the second issue of exchange-traded bonds in the amount of RUB 2 billion. ACRA has assigned an A (RU) rating to the issue. The order book was preliminarily closed with high demand, totaling over RUB 3.1 billion. During bid collection, oversubscription equaled 60%, which led to a 10-bp reduction in the coupon rate. The final rate is up to 9.15%.

On April 4, 2023, the Group placed the third issue of exchange-traded bonds in the amount of 1.5 billion rubles under the program registered on the Moscow Exchange. The rating agency "Expert RA" has determined the rating of the issue at a high level of ruA.

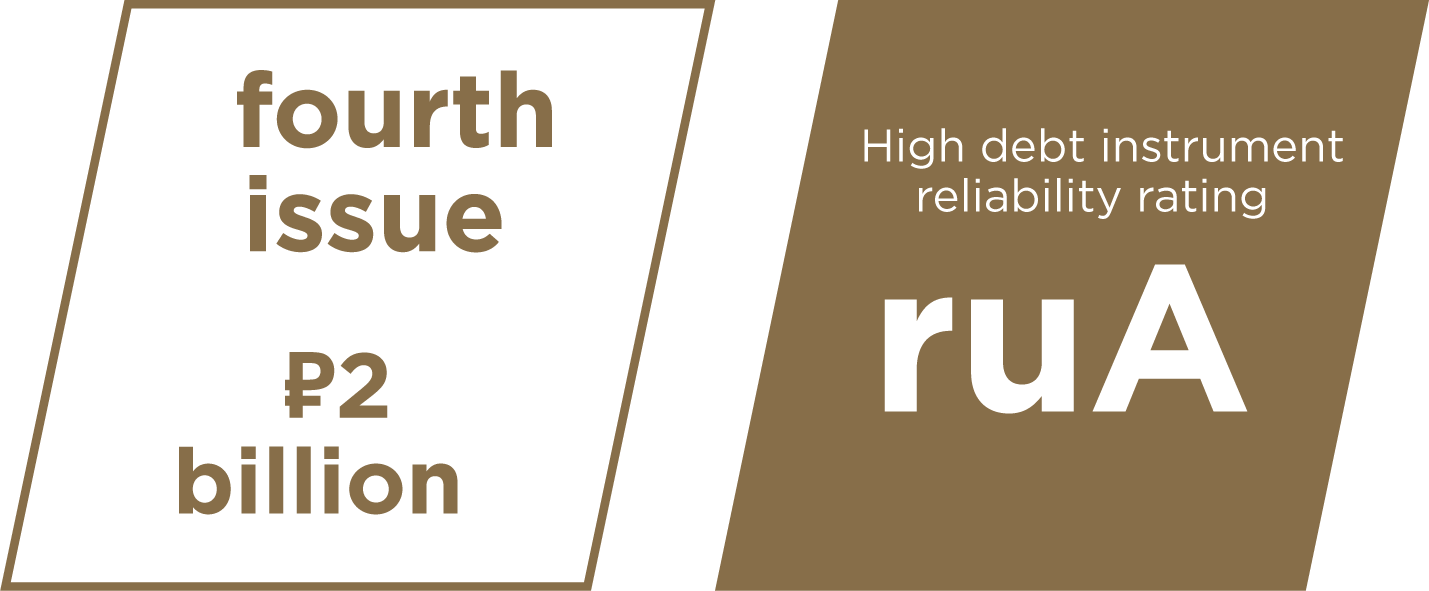

In June 2023, VIS Group placed its fourth issue of exchange-traded bonds

On June 30, 2023, the Group placed its fourth issue of exchange-traded bonds with a volume of 2 billion rubles. The application collection was initially set at 1.5 billion rubles, but due to high investor interest in the holding's bonds, the volume was increased. The rating of the issue has been confirmed at the ruA level.

In December 2023, VIS Group placed its fifth issue of exchange-traded bonds.

On December 14, VIS Group placed series BO-P05 bonds in the amount of 2 billion rubles. The Expert RA rating agency assigned the securities a credit rating of ruA+, which corresponds to the Group’s rating.

In September 2024, VIS Group placed its sixth issue of exchange-traded bonds.

On September 25, 2024, the Group placed bonds with a variable coupon rate for the first time, which is calculated based on the key rate of the Bank of Russia and a spread of 3.25% per annum. The sixth issue of exchange bonds amounted to RUB 2.5 billion. The order book was closed with high demand. The Expert RA rating agency assigned the securities a credit rating of ruA+.