01.12.2023

The maturity of the bonds is 4 years (1,456 days). The nominal value of each security is 1000 rubles. The target rate of the 1st coupon is no higher than 15.90% per annum, which corresponds to a yield to put of no more than 16.87% per annum. The coupon duration period will be 91 days. Placement method: bookbuilding using a coupon, open subscription. The organizers of the issue are Gazprombank, Sinara investment bank, and IFC Solid.

This will be the fifth issue of securities within the framework of VIS Group’s 30-billion-ruble program registered on the Moscow Exchange. In total, the holding's exchange-traded bonds are in circulation today in the amount of 8 billion. The Group's high reliability and creditworthiness rating is confirmed by the leading Russian rating agencies ACRA (A(RU)) and Expert RA (ruA+). The funds raised are used to finance promising projects and to refinance completed projects, as well as to support operational activities.

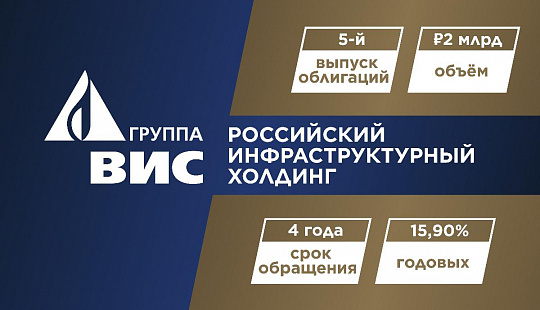

VIS Group plans to collect applications for bonds with a coupon target of 15.90% per annum

On December 12, the holding’s issuing company, OOO VIS FINANCE, plans to collect applications for the issue of series BO-P05 bonds. Technical placement is scheduled for December 14. The offer in the amount of 2 billion rubles will be valid for 1.5 years.The maturity of the bonds is 4 years (1,456 days). The nominal value of each security is 1000 rubles. The target rate of the 1st coupon is no higher than 15.90% per annum, which corresponds to a yield to put of no more than 16.87% per annum. The coupon duration period will be 91 days. Placement method: bookbuilding using a coupon, open subscription. The organizers of the issue are Gazprombank, Sinara investment bank, and IFC Solid.

This will be the fifth issue of securities within the framework of VIS Group’s 30-billion-ruble program registered on the Moscow Exchange. In total, the holding's exchange-traded bonds are in circulation today in the amount of 8 billion. The Group's high reliability and creditworthiness rating is confirmed by the leading Russian rating agencies ACRA (A(RU)) and Expert RA (ruA+). The funds raised are used to finance promising projects and to refinance completed projects, as well as to support operational activities.